2024-2025 Budget Public Hearing Information

A public hearing on the proposed 2024-2025 proposed county budget and tax levy was held virtually and in person on Wednesday, Dec. 6 at the Maplewood Community Center.

View a recording of the hearing

Hearing summary

- Interpreters were provided in ASL, Spanish, Hmong, Karen, Oromo and Somali for both in-person and online participants.

- Approximately 60 members of the community and seven staff members attended the hearing in person.

- 50 members of the community and 10 staff members attended the hearing virtually.

- 20 spoken public comments were made in person and six spoken public comments were made via Zoom.

- County Assessor staff were available in person during the hearing to address individual questions about property valuations. Eighteen members of the public spoke with an appraiser in person.

- Staff received thirteen requests for additional follow-up, with five including additional written feedback.

If you were unable to attend the public hearing you may still submit comments on the budget to the board of commissioners.

Commissioner remarks

Commissioner Trista Martinson, County Board Chair, offered opening remarks and instructions for participating in the meeting. Commissioner Victoria Reinhardt, Budget Committee Chair presented information about the proposed budget.

County Board Chair Martinson remarks

On behalf of my colleagues on the board and Ramsey County staff here this evening, I’d like to welcome you to the 2024 Ramsey County Budget and Tax Public Hearing. We are joined by Hmong, Karen, Oromo, Somali and Spanish interpreters as well as ASL interpreters. Jason Yang will now walk us through how to use an interpreter channel for tonight’s hearing.

Thank you, Jason and thank you to all of our interpreters this evening. If you would like to have tonight’s proceedings translated for you, please connect with one of our interpreter channels at this time. Thank you all for coming this evening. And thanks to those of you who are participating through our zoom platform. Following tonight’s hearing, the video of this hearing will be available through our website ramseycounty dot US.

I’d like to introduce your Ramsey County commissioners. Please stand as I call your district, introduce yourself and let our audience know what cities and neighborhoods you represent:

[Commissioner introductions]

Now let’s please stand for the Pledge of Allegiance.

I’d like to preview tonight’s schedule before handing the meeting over to Commissioner Reinhardt, who is chair of our Budget Committee. Commissioner Reinhardt will provide a formal budget introduction. Our program will begin with a short presentation from our County Manager, County Assessor and County Auditor/Treasurer sharing an overview and impacts of the levy and some historical trends. Then, we’ll ask for your input. This public hearing is an opportunity for you to share your thoughts on the budget and property taxes with commissioners.

In a hearing format, you are providing public testimony for the record. Each person who would like to provide input will have three minutes to address the board members. We will go in order of those who are joining in person, then those who are joining by Zoom.If you haven’t attended a hearing before, it is a unique format. Your comments are for the record as public testimony on the budget. As elected officials, we listen closely to your comments but do not respond directly to questions.

If you are here with questions about your property’s valuation, staff from the Ramsey County Assessor’s Office is available to talk with you this evening. You can meet with them outside of this room at any point this evening.

General questions and themes that arise from tonight’s commentary will be answered following this hearing on our website at Ramsey county dot US slash budget.

Your feedback tonight and following this meeting is very important to us as we move toward final budget approval on December 12.

Now I’ll hand it over to Budget Chair Reinhardt --- who will then hand it over to County Manager O’Connor for the short presentation.

Budget Committee Chair Reinhardt remarks

Tonight, I respectfully submit the proposed Ramsey County budget for public comment.

This fall the Ramsey County Board of Commissioners approved a maximum property tax levy of three hundred seventy-eight million, thirty-four thousand, five hundred and forty-six dollars [$378,034,546 dollars] to finance the 2024 budget which calls for total spending of eight hundred thirteen million, three hundred and ninety-five thousand, one hundred and ninety-two dollars [813,395,192 dollars]. This overall proposed budget increase is about twenty-eight million dollars [28 million] higher than the 2023 budget.

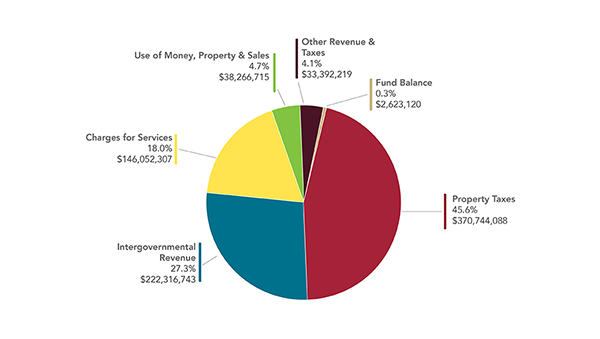

Property taxes fund about forty-six percent [46 percent] of the budget.

Please know that we make every effort to provide Ramsey County taxpayers with essential services at an affordable cost. We take our responsibilities very seriously as stewards of residents’ hard-earned money and work to craft budgets that are cost-effective, prudent and predictable without uneven variations in the levy year-to-year.

The county is in strong financial standing as evidenced by the fact that we are one of few counties nationwide holding a triple A bond rating by the top rating agencies and have held this rating since 2001. Essentially, this is like having a great credit score – it allows us to spend less when we need to borrow money.

After we hear from you this evening, final budget approval by the Board will occur on December 12. The final approved property tax levy may not exceed the maximum levy set in September, but may be lower. Changes to the budget may occur by actions taken by the board, but there will be no increase in the levy as a result of those changes.

We’re here to listen to you tonight. Thank you for your time and consideration. We look forward to your comments and suggestions. At this point, I will turn it over to County Manager O’Connor for a short presentation.

Questions from Dec. 6 budget hearing

During the 2024-2025 budget process, questions in the following topic areas were raised by members of the public. Please see questions and responses below.

What is the county’s budget for 2024-2025?

The county’s approved budget for 2024 totals $808,498,799 which represents a 2.9% overall budget increase from 2023. The 6.75% levy increase for 2024 was driven by a shift away from federal and state one-time resources that were available during the emergency pandemic. The approved budget for 2025 totals $835,076,779, with an 3.3% budget increase from 2024 and a maximum 4.75% levy increase that is proposed to be reduced once estimates for future cannabis sales tax revenue can be incorporated.

The 2024 budget was mitigated by a $6 million increase in county program aid from the State of Minnesota. This increased state aid provided a 1.76% levy decrease from initial budget planning targets and helped keep the county’s long term levy growth at a more moderate level. Looking at the period of 2015-2025, the annual average levy growth to Ramsey County taxpayers was 3.3% and from 2021-2025 (COVID era) the annual average levy growth was 3.5%.

Where does the county’s budget come from?

Why did the levy go up?

During the pandemic, the county intentionally kept its property tax growth low by leveraging one-time federal relief dollars known as American Rescue Plan Act (ARPA) dollars and making more than $20 million in operational cuts and managing minimal operating budget increases. These were not long-term budget solutions, but strategic decisions Ramsey County made during unprecedented economic times to offer additional support and relief to residents.

Now, as we move beyond the COVID-19 pandemic and beyond one-time emergency funding, the county needs to do a right size of the budget to ensure that challenges presented by the pandemic are addressed and that we are positioned for a future that is more equitable and sustainable.

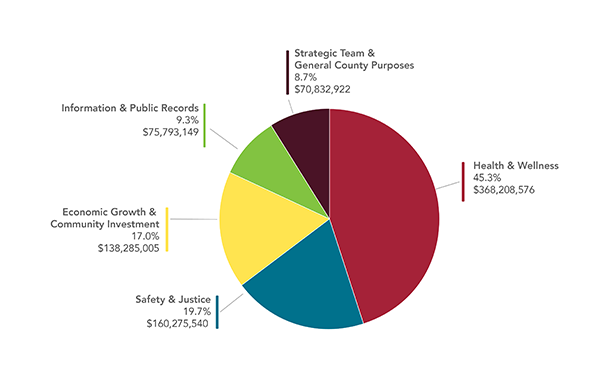

Where does the county’s budget go?

The 2024-25 biennial budget invests in both those served by the county and those providing services to the residents, businesses and visitors of Ramsey County. This includes making key investments in attracting and retaining top talent to work at the county to provide stellar service to residents. This also means investing in residents and businesses to meet the needs of the community and engaging and building trusting relationships with community to support healthy and safe communities for all.

This budget reflects the need to modernize systems to improve client access and service and deepen partnerships and collaborations with other agencies, organizations and community. Continued investments are being made in power sharing and co-creation including work on bail reform, non-public safety traffic stops and the Appropriate Responses Initiative to name a few.

This budget also focuses on continuing to enhance service delivery and particularly finding the gaps and overlaps in how services are provided and increasing accessibility. Investments are focused on how the county rethinks its usage of space and technology and opportunities to collaborate with community. An excellent example of this is Ramsey County’s ongoing investment into its Service Centers. Located in Maplewood (inside the mall), Roseville (inside the Library) and Metro Square (downtown near light rail/major bus lines), each offers public access computers, free Wi-Fi and a team of navigators equipped with information and resources to connect residents with all the services and resources the county has to offer in one location.

How is the valuation of my home appraised?

The property taxes for specific residential, commercial and apartment properties may have increased or decreased due to changes in property values. When market values increase in a neighborhood or for a property type – such as commercial – this can change how much a given property pays based on its share of the levy. Learn more in this video about understanding your property taxes and value:

-

English - Understanding Your Property Taxes and Values

-

Hmoob - Totaub Txog Cov Se Tsev thiab Lub Tsev Muaj Nqis Li Cas

-

Karen - Understanding Your Property Taxes and Values

-

Soomaali - Fahamka Cashuuraha iyo Qiimaha Hantidaada Maguurtada

-

Español - Comprendiendo los Impuestos y Valores de Su Propiedad

If you have questions about changes in your property value, please contact the County Assessor’s Office at 651-266-2131.

What tax relief programs are available for residents?

The Minnesota Department of Revenue offers tax relief for qualifying residents age 65 or older.

Other property tax refund programs are also available for qualifying property owners. Please see the reverse of your proposed tax statement or visit the Minnesota Department of Revenue’s web site for details.